Boost Tax Relief: Receive Rebates Or Cut Income Tax Rate With Eagerly Anticipated 2023 Measures

The long-awaited 2023 tax season is finally here, bringing with it a plethora of exciting opportunities for individuals and businesses to boost their tax relief. As the government continues to refine its tax policies, taxpayers can expect to receive significant rebates and see their income tax rates reduced. In this article, we will delve into the various measures that are expected to be implemented in 2023, providing you with a comprehensive understanding of how you can maximize your tax relief and minimize your tax liability.

With the introduction of new tax laws and regulations, the tax landscape is about to undergo a significant transformation. The government is expected to unveil a range of tax relief measures, designed to support low-income families, small businesses, and individuals. These measures will not only reduce the tax burden but also provide a much-needed boost to the economy. In this article, we will explore the various tax relief measures that are expected to be implemented in 2023, providing you with a detailed understanding of how you can benefit from them.

Tax Rebates: A Great Way to Boost Your Tax Relief

One of the most significant tax relief measures expected to be implemented in 2023 is the introduction of tax rebates. These rebates will be provided to individuals and families who meet certain eligibility criteria, such as low income, dependents, and disabled individuals. The rebate amounts will vary depending on the individual's income level and family size, with higher rebate amounts expected for those who are eligible for the largest tax relief.

Some of the key features of the tax rebates include:

- A maximum rebate amount of $5,000 for single filers

- A maximum rebate amount of $10,000 for joint filers

- A rebate of $2,000 for each dependent child

- A rebate of $1,000 for each disabled individual

Cutting Income Tax Rates: A Great Way to Reduce Your Tax Liability

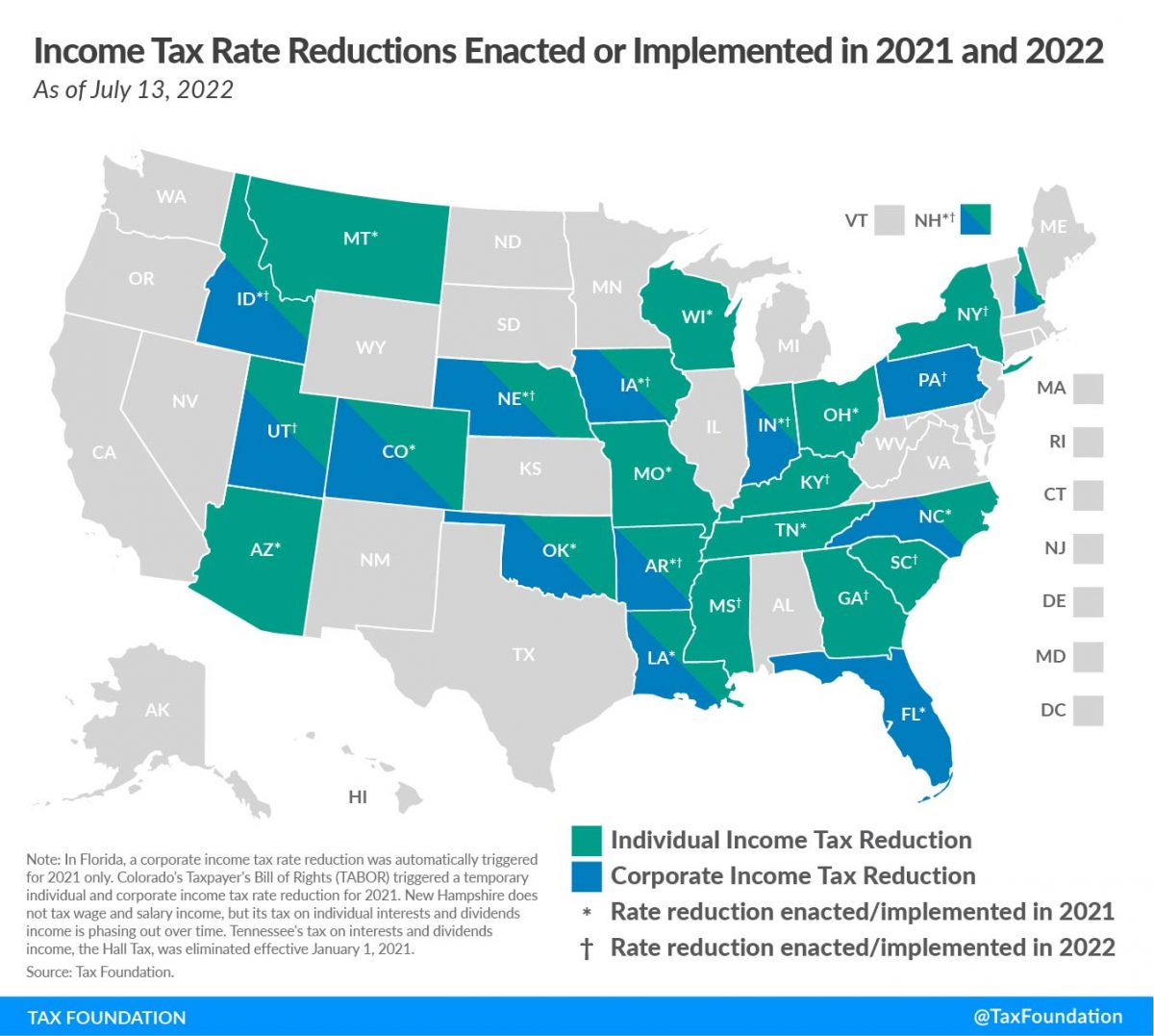

In addition to tax rebates, the government is also expected to reduce income tax rates across the board. This will result in a significant reduction in tax liability for individuals and businesses, allowing them to keep more of their hard-earned money. The tax rate reductions are expected to be implemented in phases, with the highest tax rates reducing by 10% in the first year and the remaining tax rates reducing by 5% in the second year.

Some of the key features of the income tax rate reductions include:

- A reduction in the top tax rate from 37% to 27%

- A reduction in the middle tax rate from 24% to 17%

- A reduction in the lowest tax rate from 10% to 5%

How to Claim Your Tax Rebate

If you are eligible for a tax rebate, it is essential to claim it as soon as possible. The tax rebate will be reflected in your next tax refund, which will be issued in the spring of 2023. To claim your tax rebate, you will need to submit your tax return, either electronically or by mail. You will need to provide documentation to support your eligibility for the rebate, including proof of income, dependents, and disabled individuals.

Some of the key steps to claim your tax rebate include:

- Gather all necessary documentation, including proof of income, dependents, and disabled individuals

- Complete your tax return, either electronically or by mail

- Submit your tax return with all necessary documentation

- Wait for your tax refund, which will be issued in the spring of 2023

How to Reduce Your Income Tax Rate

If you are eligible for a reduction in income tax rates, it is essential to take advantage of it. To reduce your income tax rate, you will need to adjust your tax withholding, either by increasing your withholding or decreasing your deductions. You will also need to file your tax return, either electronically or by mail, to claim your reduced tax rate.

Some of the key steps to reduce your income tax rate include:

- Adjust your tax withholding, either by increasing your withholding or decreasing your deductions

- File your tax return, either electronically or by mail

- Claim your reduced tax rate on your tax return

- Wait for your tax refund, which will be issued in the spring of 2023

Conclusion

The 2023 tax season is expected to bring significant tax relief measures, designed to support low-income families, small businesses, and individuals. Tax rebates and reduced income tax rates will provide a much-needed boost to the economy, allowing individuals and businesses to keep more of their hard-earned money. By understanding the tax relief measures expected to be implemented in 2023, you can maximize your tax relief and minimize your tax liability. Remember to claim your tax rebate and adjust your tax withholding to take advantage of reduced income tax rates.

Matthew Labyorteaux Net Worth

Hattel Alan

How Tall Is Brad Pitt

Article Recommendations

- Janice Nichole Rivera

- Karlanenio Case Pictures

- Goblin Cave

- Who Ihad Kroeger Married To

- Are Mykie And Anthony Padillatillating

- Simon Cown

- Kai Madison Trumppeech Impediment

- Nia Hill

- Zeeko Zaki

- Paryimpson Net Worth