US Chaos Sparks Global Central Bank Response: What You Need To Know

The recent unrest in the United States has sent shockwaves across the globe, triggering a strong response from central banks worldwide. As the situation continues to unfold, it's essential to understand the implications of this global event and how it may impact the economy. In this article, we'll delve into the details of the US chaos, its effects on the global economy, and the response from central banks.

The US has been experiencing a period of significant social and economic upheaval, with widespread protests and demonstrations erupting across the country. These protests have been driven by a range of factors, including income inequality, racial tensions, and concerns about the country's economic future. As the situation continues to unfold, it's clear that the US is facing a period of significant instability, with far-reaching implications for the global economy.

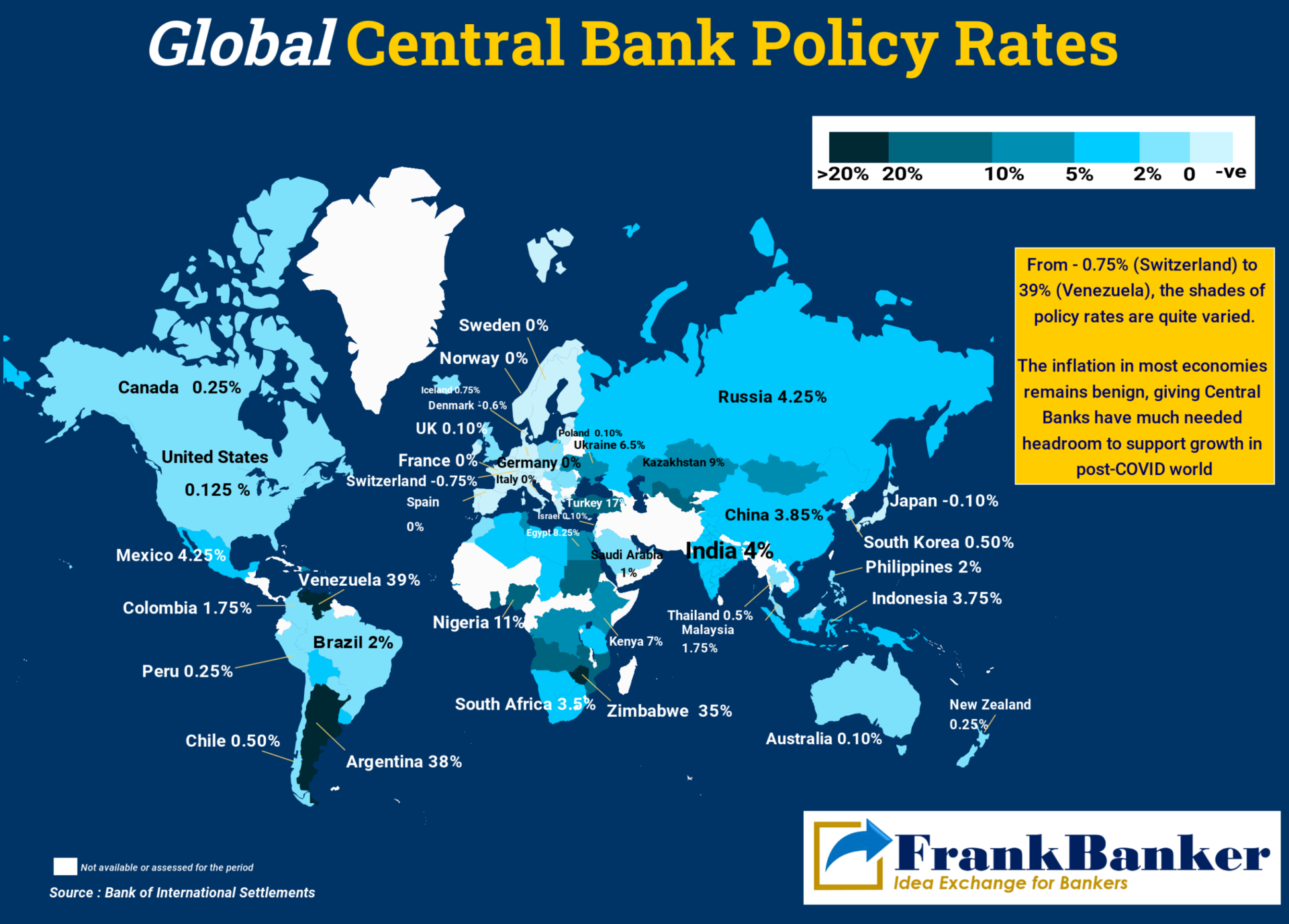

Central banks around the world have been closely monitoring the situation, and several have already taken steps to address the potential consequences. From the Federal Reserve in the US to the European Central Bank in Europe, these institutions are playing a critical role in maintaining financial stability and mitigating the effects of global economic uncertainty.

The Impact of US Chaos on the Global Economy

The impact of the US chaos on the global economy has been significant, with several key effects already becoming apparent. Some of the most notable include:

• Increased uncertainty: The ongoing protests and demonstrations in the US have created a significant amount of uncertainty, which is being felt across the globe. This uncertainty is affecting investor confidence, leading to a decline in stock markets and a rise in volatility.

• Trade tensions: The US-China trade war has already had a significant impact on the global economy, and the ongoing protests in the US are likely to exacerbate tensions between the two countries.

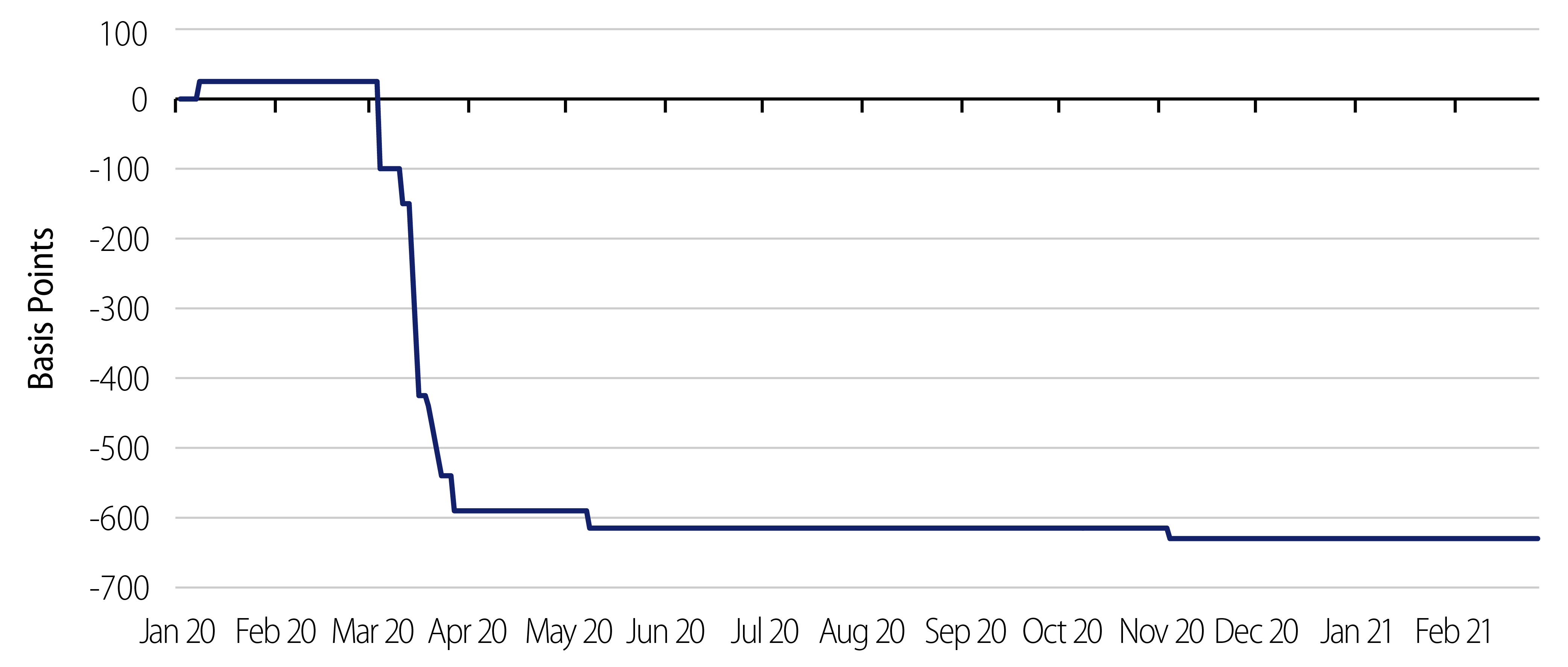

• Interest rate decisions: Central banks are closely monitoring the situation, and several have already made interest rate decisions in response to the increased uncertainty. For example, the Federal Reserve has cut interest rates in an effort to stimulate economic growth.

• Currency fluctuations: The value of the US dollar has been fluctuating wildly in response to the increased uncertainty, with some analysts predicting a significant decline in the value of the currency.

Central Bank Response

Central banks around the world have been quick to respond to the US chaos, with several taking steps to address the potential consequences. Some of the key measures include:

Federal Reserve Response

The Federal Reserve has been at the forefront of the central bank response, taking several key steps to address the potential consequences of the US chaos. These measures include:

- Cutting interest rates: The Federal Reserve has cut interest rates in an effort to stimulate economic growth and reduce the impact of the uncertainty.

- Providing liquidity: The Fed has also taken steps to provide liquidity to the financial system, including purchasing government bonds and offering emergency loans to banks.

- Monitoring the situation closely: The Fed is closely monitoring the situation, and is working closely with other central banks and financial institutions to address the potential consequences.

European Central Bank Response

The European Central Bank has also been quick to respond, taking several key steps to address the potential consequences of the US chaos. These measures include:

- Cutting interest rates: The ECB has cut interest rates in an effort to stimulate economic growth and reduce the impact of the uncertainty.

- Providing liquidity: The ECB has also taken steps to provide liquidity to the financial system, including purchasing government bonds and offering emergency loans to banks.

- Monitoring the situation closely: The ECB is closely monitoring the situation, and is working closely with other central banks and financial institutions to address the potential consequences.

Other Central Bank Responses

Other central banks around the world have also been quick to respond, taking several key steps to address the potential consequences of the US chaos. Some of the key measures include:

- Raising interest rates: The Bank of Japan has raised interest rates in an effort to stimulate economic growth and reduce the impact of the uncertainty.

- Providing liquidity: The People's Bank of China has taken steps to provide liquidity to the financial system, including purchasing government bonds and offering emergency loans to banks.

- Monitoring the situation closely: Central banks around the world are closely monitoring the situation, and are working closely with other central banks and financial institutions to address the potential consequences.

The Future of the Global Economy

The future of the global economy remains uncertain, with several key factors contributing to the ongoing instability. Some of the most notable include:

Economic Slowdown

The global economy has been experiencing a slowdown in recent months, with several key indicators showing a decline in economic activity. This slowdown is likely to continue, at least in the short term, as the ongoing protests and demonstrations in the US continue to impact global trade and investment.

Trade Tensions

The ongoing trade tensions between the US and China have already had a significant impact on the global economy, and are likely to continue to exacerbate tensions between the two countries.

Interest Rate Decisions

Central banks are closely monitoring the situation, and several have already made interest rate decisions in response to the increased uncertainty. For example, the Federal Reserve has cut interest rates in an effort to stimulate economic growth.

Currency Fluctuations

The value of the US dollar has been fluctuating wildly in response to the increased uncertainty, with some analysts predicting a significant decline in the value of the currency.

What to Expect Next

As the situation continues to unfold, it's clear that the future of the global economy remains uncertain. However, several key factors are likely to influence the outcome, including:

• Central bank decisions: Central banks are likely to continue to play a critical role in addressing the potential consequences of the US chaos, with several likely to make further interest rate decisions in the coming weeks and months.

• Economic data: The ongoing economic slowdown is likely to continue, at least in the short

Madison Beer Parents

Brad Pitt Height In Feet

Ranran Fujii Insta

Article Recommendations

- Kaitlyn Krems Fans

- Hisashi Real Pos

- Candal

- How Tall Iarleyhimkus

- Malcolm Gladwell Wife

- Kaitlan Collins

- Beyonce

- Kelly Mcgillis

- Tiktok Unblocked

- Jennifer Landon