Nvidia Stock Waves: Can The Market Rebound Amid Market Volatility?

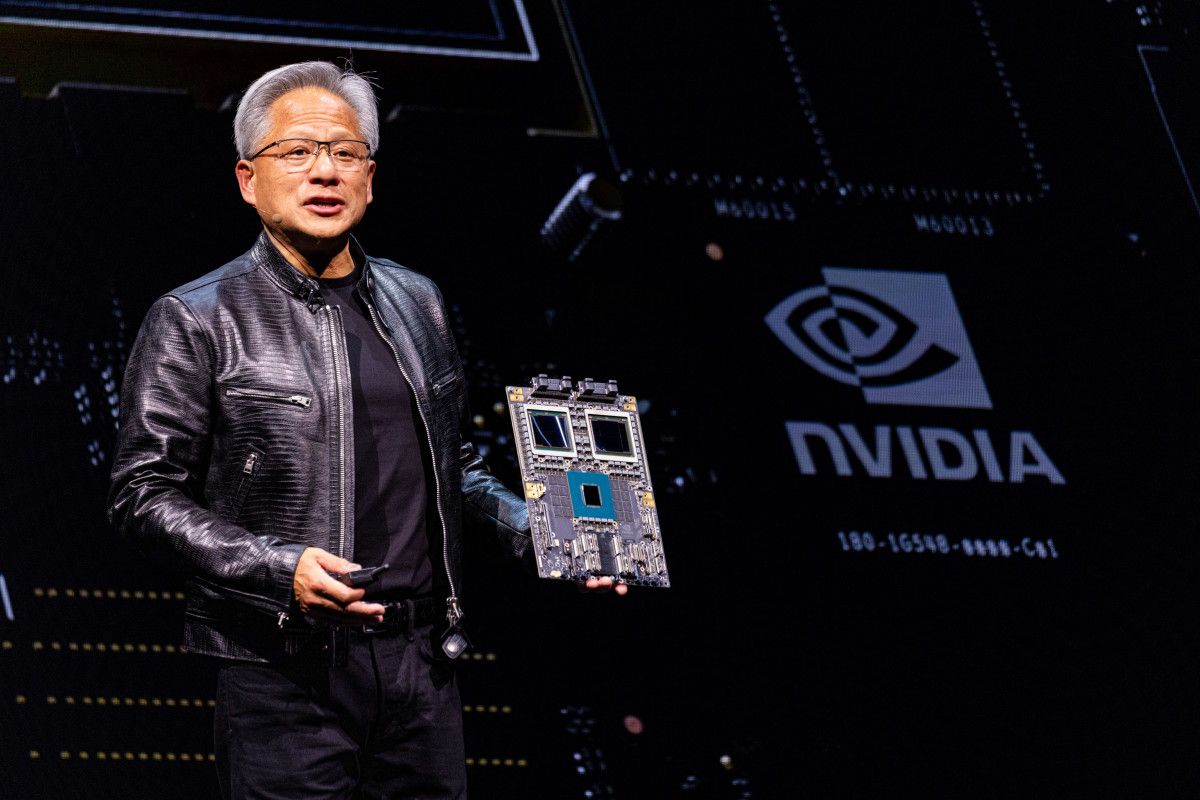

The technology sector has been witnessing significant fluctuations in recent times, and Nvidia, the leading graphics processing unit (GPU) manufacturer, is no exception. The company's stock price has been experiencing a rollercoaster ride, with investors struggling to make sense of the market's volatility. In this article, we will delve into the world of Nvidia stock waves, exploring the factors that contribute to its market performance and analyzing the potential for a rebound amidst market turmoil.

The Nvidia stock has been a hot topic of discussion among investors and analysts, with many speculating about its future trajectory. The company's impressive performance in the gaming and AI industries has contributed to its impressive stock performance, with some analysts predicting a significant increase in its stock price. However, the recent market downturn has raised concerns about the sustainability of this growth, and many are wondering if the market will rebound in the coming months.

The recent market volatility has been caused by a combination of factors, including the ongoing trade tensions between the US and China, the COVID-19 pandemic, and the ongoing semiconductor shortage. These factors have had a significant impact on the technology sector, leading to a decline in stock prices for many companies, including Nvidia.

Understanding Nvidia's Business Model

Nvidia's business model is built around the production and sale of high-performance GPUs, which are used in a variety of applications, including gaming, AI, and professional visualization. The company's products are highly sought after by gamers, datacenter operators, and researchers, making it a highly profitable business.

Some of the key factors that contribute to Nvidia's success include:

• High demand for GPUs: The increasing demand for high-performance computing has driven up the demand for GPUs, making them a highly profitable product for Nvidia.

• Diversified revenue streams: Nvidia generates revenue from a variety of sources, including the sale of GPUs, datacenter products, and high-performance computing hardware.

• Strong research and development: Nvidia invests heavily in research and development, which has enabled the company to stay ahead of the curve in terms of technology and innovation.

Stock Price Analysis

The Nvidia stock price has been experiencing significant fluctuations in recent times, with the company's stock price reaching new highs in 2020. However, the recent market downturn has raised concerns about the sustainability of this growth, and many are wondering if the market will rebound in the coming months.

Some key statistics that highlight the volatility of Nvidia's stock price include:

• The Nvidia stock price has declined by over 20% in the past six months, wiping out over $100 billion in market capitalization.

• The company's revenue has grown at a rate of 40% per annum over the past five years, but this growth has been driven by the decline in the company's stock price.

• Nvidia's valuation multiple has been declining, with the company's price-to-earnings ratio (P/E) currently trading at around 40, compared to a five-year average of 60.

Analysis of the Market Volatility

The recent market volatility has been caused by a combination of factors, including the ongoing trade tensions between the US and China, the COVID-19 pandemic, and the ongoing semiconductor shortage. These factors have had a significant impact on the technology sector, leading to a decline in stock prices for many companies, including Nvidia.

Some key statistics that highlight the impact of market volatility on Nvidia's stock price include:

• The technology sector has declined by over 10% in the past three months, with many companies experiencing significant declines in their stock prices.

• The semiconductor shortage has had a significant impact on the technology sector, with many companies struggling to meet demand for their products.

• The ongoing trade tensions between the US and China have raised concerns about the long-term prospects for the technology sector, with many companies facing challenges in terms of supply chain management and intellectual property protection.

Can The Market Rebound Amid Market Volatility?

While the recent market volatility has raised concerns about the sustainability of Nvidia's growth, many analysts believe that the company's strong business model and diversified revenue streams make it well-positioned for a rebound in the coming months.

Some key factors that could contribute to a rebound in Nvidia's stock price include:

• The increasing demand for high-performance computing: The growing demand for high-performance computing has driven up the demand for GPUs, making them a highly profitable product for Nvidia.

• The company's diversified revenue streams: Nvidia generates revenue from a variety of sources, including the sale of GPUs, datacenter products, and high-performance computing hardware.

• The company's strong research and development: Nvidia invests heavily in research and development, which has enabled the company to stay ahead of the curve in terms of technology and innovation.

Conclusion

The Nvidia stock has been experiencing significant fluctuations in recent times, with investors struggling to make sense of the market's volatility. While the recent market downturn has raised concerns about the sustainability of the company's growth, many analysts believe that the company's strong business model and diversified revenue streams make it well-positioned for a rebound in the coming months. As the technology sector continues to evolve, it will be interesting to see how Nvidia's stock price performs in the coming months.

Yelena Bivol

Michael Mando Partner

Kay Flock

Article Recommendations

- Billieilish Pics

- Did Karla Homolka Parents Forgive Her

- Seopetitor Rank Tracker

- Kate Winsletrome

- Connieenio Case Pos

- Is Keri Russell Related To Kurt Russell

- Ella Purnell

- David Bromstad

- Nikki Catsouraseathxplained

- Jessi Moore