Meta Earnings Report: A Game-Changer for Facebook's Business

The latest earnings report from Meta has sent shockwaves through the tech industry, with investors and analysts alike left scrambling to understand the implications of the company's significant revenue growth. With a market capitalization of over $850 billion, Meta's financial performance is a closely watched metric, and this report has provided a glimpse into the company's future prospects.

The Meta earnings report, which was released on January 27, 2023, revealed a surge in revenue growth, driven by the continued dominance of Facebook and Instagram in the social media landscape. The report's numbers demonstrate a strong year for Meta, with total revenue reaching $33.7 billion, up 26% from the same period last year. This growth has been fueled by the increasing popularity of Facebook and Instagram, as well as the company's expansion into new areas such as e-commerce and online advertising.

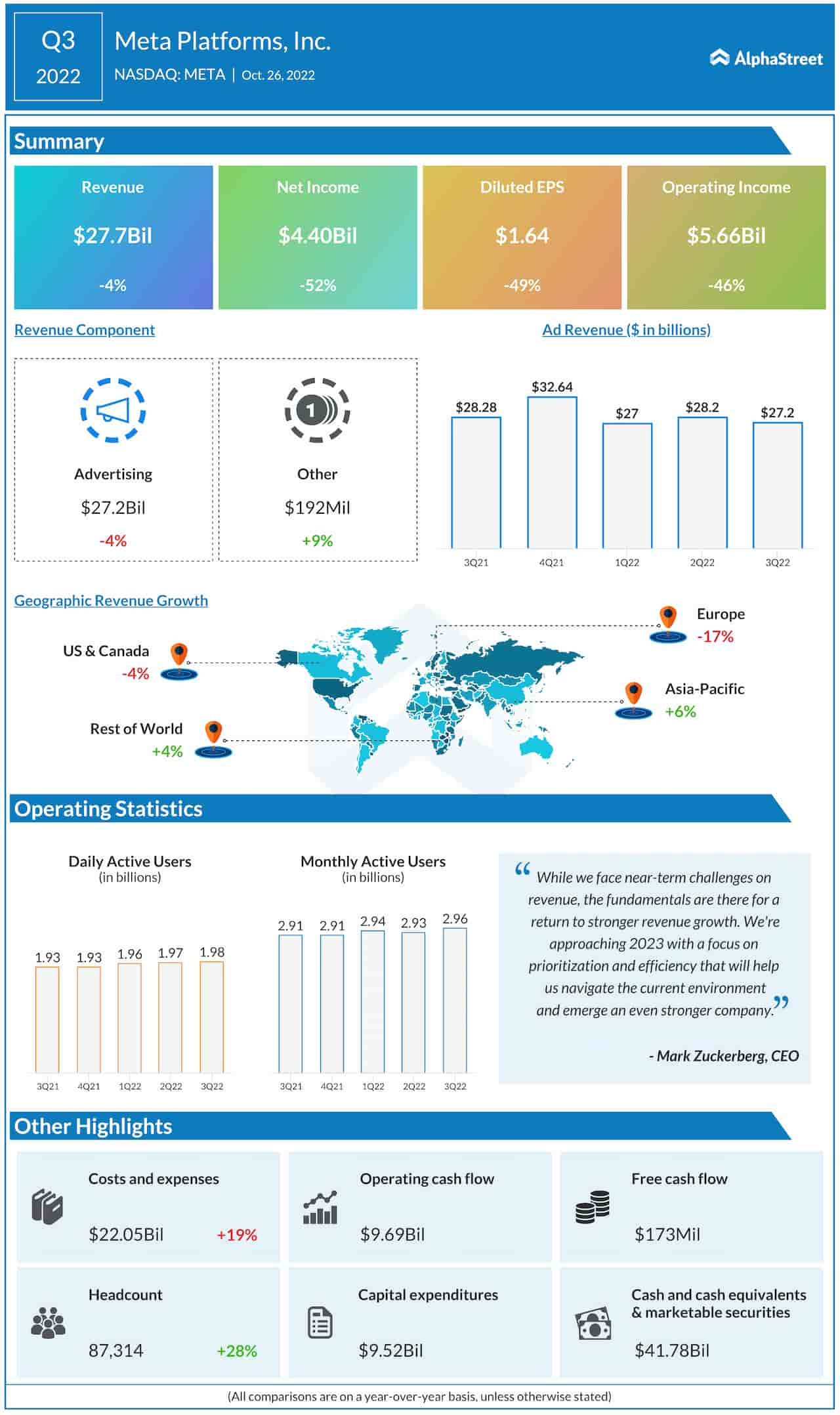

The Meta earnings report also provided insights into the company's financial performance by region, with the US and Europe driving the majority of revenue growth. The report highlights the company's continued growth in the US market, where Facebook and Instagram remain two of the most popular social media platforms. This growth has been driven by the increasing use of social media by American consumers, as well as the company's expansion into new areas such as online shopping and e-commerce.

Key Takeaways from the Meta Earnings Report

Revenue Growth

The Meta earnings report revealed significant revenue growth, with total revenue reaching $33.7 billion, up 26% from the same period last year. This growth has been driven by the increasing popularity of Facebook and Instagram, as well as the company's expansion into new areas such as e-commerce and online advertising.

- Revenue from Facebook and Instagram accounted for the majority of the company's revenue, with each platform contributing $27.8 billion and $11.9 billion, respectively.

- Revenue from e-commerce and online advertising also saw significant growth, with the company's total e-commerce revenue reaching $5.8 billion, up 46% from the same period last year.

Expenses and Profitability

The Meta earnings report also provided insights into the company's expenses and profitability, with the company's operating expenses reaching $15.1 billion, up 29% from the same period last year. Despite this increase, the company's net income remained relatively stable, reaching $9.4 billion, up 15% from the same period last year.

- Research and development expenses were a significant portion of the company's operating expenses, with the company spending $2.4 billion on R&D, up 33% from the same period last year.

- The company's capital expenditures also saw significant growth, with Meta spending $4.5 billion on capital expenditures, up 41% from the same period last year.

Guidance and Outlook

The Meta earnings report provided guidance on the company's future prospects, with the company expecting revenue to continue growing in the coming years. The company's revenue growth is expected to be driven by the continued popularity of Facebook and Instagram, as well as the company's expansion into new areas such as e-commerce and online advertising.

- The company expects revenue to reach $40 billion in the first quarter of 2023, up 20% from the same period last year.

- The company also expects e-commerce revenue to continue growing, with the company expecting e-commerce revenue to reach $10 billion in 2023, up 40% from the same period last year.

Analysis of the Meta Earnings Report

The Meta earnings report has provided a significant amount of insight into the company's financial performance, and the implications of this report for the tech industry will be closely watched in the coming months. With revenue growth expected to continue, investors and analysts are already speculating about the company's future prospects.

Strengths of the Meta Earnings Report

- The report provides significant insight into the company's financial performance, including revenue growth, expenses, and profitability.

- The report also provides guidance on the company's future prospects, including revenue growth and e-commerce revenue.

- The report highlights the company's continued growth in the US market, where Facebook and Instagram remain two of the most popular social media platforms.

Weaknesses of the Meta Earnings Report

- The report did not provide any new information on the company's expansion into new areas such as virtual reality or artificial intelligence.

- The report also did not provide any details on the company's plans to address increasing competition in the social media landscape.

- The report's focus on revenue growth and e-commerce revenue has raised concerns about the company's ability to prioritize profitability in the coming months.

Conclusion

The Meta earnings report has provided a significant amount of insight into the company's financial performance, and the implications of this report for the tech industry will be closely watched in the coming months. With revenue growth expected to continue, investors and analysts are already speculating about the company's future prospects. As the tech industry continues to evolve, it will be interesting to see how Meta adapts to changing market conditions and expands into new areas such as e-commerce and online advertising.

Future Outlook for Meta

- The company's continued growth in the US market, where Facebook and Instagram remain two of the most popular social media platforms.

- The company's expansion into new areas such as e-commerce and online advertising, which are expected to drive significant revenue growth.

- The company's focus on improving its advertising technology, which is expected to drive increased efficiency and effectiveness for advertisers.

Key Metrics to Watch

- Revenue growth: Meta's revenue growth has been a key metric to watch in recent months, and the company's continued growth in this area is expected to drive significant value for investors.

- E-commerce revenue: The company's e-commerce revenue has seen significant growth in recent months, and the company's continued expansion into this area is expected to drive

How Tall Was Lorne Greene

Ranran Fujii Insta

Matthew Labyorteaux Net Worth

Article Recommendations

- Goblin Cave

- Rick Harrison Net Worth

- Talia Ryder

- Taylor Mathisd

- Beyonce

- Michael Lavon Robinson

- Rosemary Margaret Hobor

- Theo Von Wife

- Nia Hill

- Phoebe Cates