Is JPMorgan Chase Stock Time to Buy? A Comprehensive Analysis for Investors

The world of finance is constantly evolving, and investors are always on the lookout for the next big opportunity. One of the largest and most well-established financial institutions in the world is JPMorgan Chase, a company with a rich history dating back to 1877. With a presence in over 100 countries, JPMorgan Chase is a household name, and its stock is widely traded on the New York Stock Exchange (NYSE) under the ticker symbol JPM. But is JPMorgan Chase stock time to buy? In this article, we'll delve into the company's financials, performance, and industry trends to provide a comprehensive analysis of whether JPMorgan Chase stock is a buy or hold for investors.

JPMorgan Chase is a diversified financial services company with a range of businesses, including consumer and community banking, corporate and investment banking, commercial banking, and markets and investment management. The company has a strong presence in the US market, with a large network of branches and ATMs, as well as a significant international presence. JPMorgan Chase's revenue comes from a variety of sources, including consumer lending, commercial lending, investment banking, and asset management.

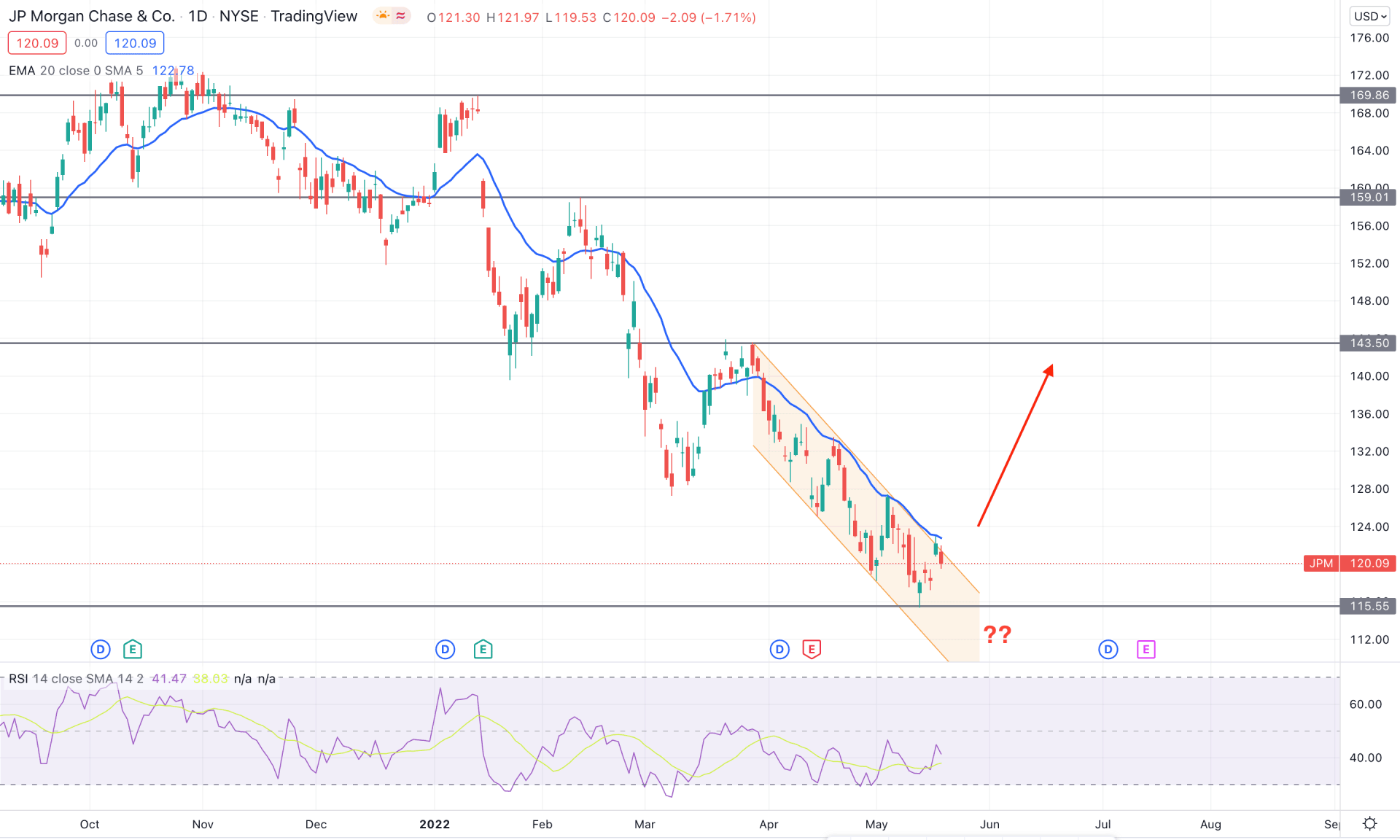

In recent years, JPMorgan Chase has faced several challenges, including increased competition from fintech companies, rising regulatory costs, and a decline in interest rates. However, the company has also made significant investments in digital transformation, with a focus on enhancing customer experience and improving operational efficiency. JPMorgan Chase's commitment to innovation has led to the development of new products and services, such as its digital-only bank, Chase Mobile, and its investment management platform, J.P. Morgan Asset & Wealth Management.

JPMorgan Chase's Financial Performance

Revenue Growth and Profitability

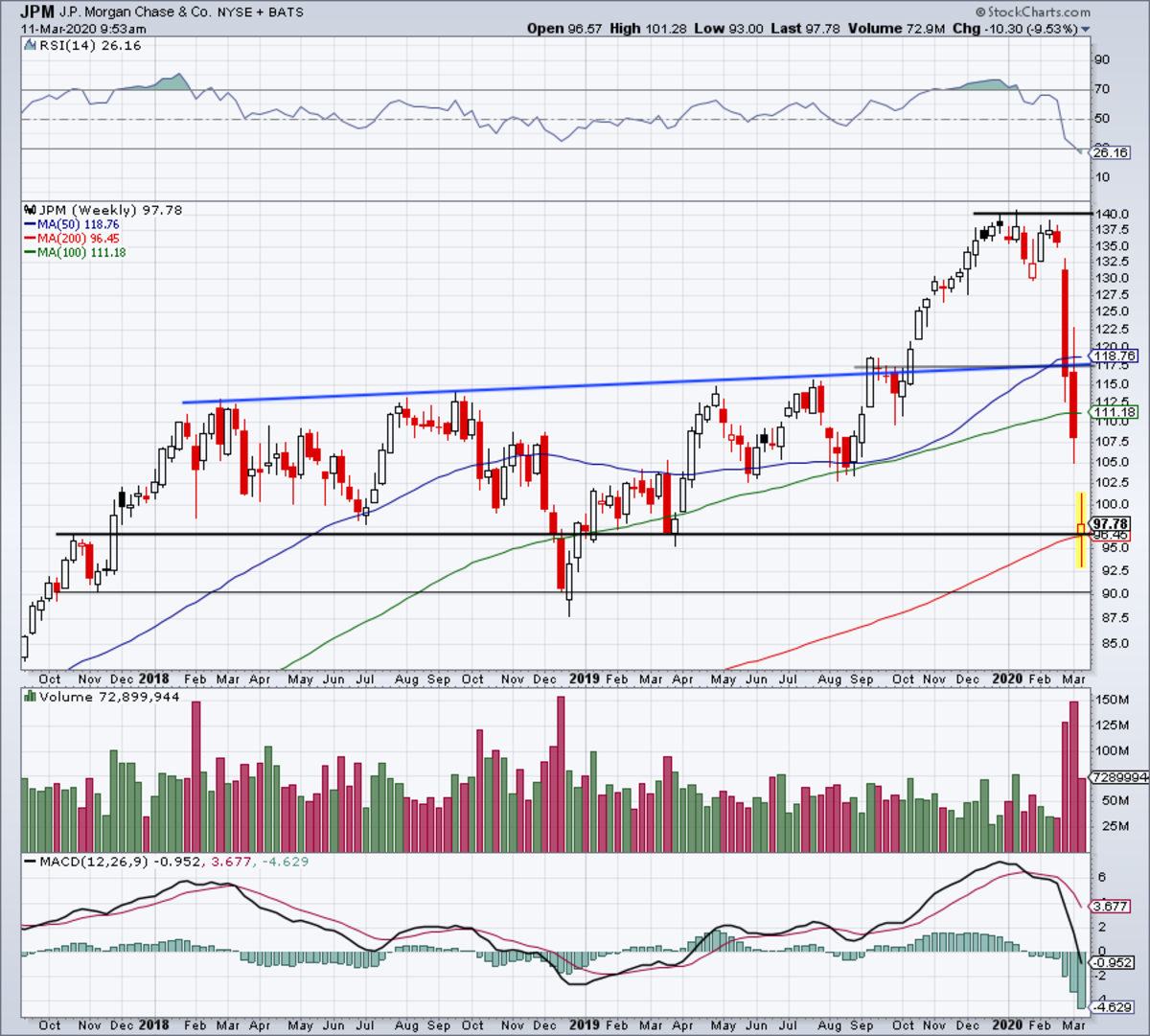

JPMorgan Chase's revenue has been growing steadily over the years, driven by increases in consumer lending, commercial lending, and investment banking revenue. In 2020, the company reported revenue of $104.1 billion, a 10% increase from the previous year. Net income also increased, reaching $29.1 billion, a 14% increase from 2019.

Expense Management and Capital Allocation

JPMorgan Chase has made significant investments in expense management, with a focus on reducing costs and improving operational efficiency. The company has implemented various cost-cutting measures, including the elimination of certain positions and the reduction of overhead costs. JPMorgan Chase has also made significant investments in its technology infrastructure, with a focus on enhancing digital capabilities and improving customer experience.

Capital Allocation and Share Buybacks

JPMorgan Chase has a strong capital position, with a book value of $244 billion and a debt-to-equity ratio of 0.14. The company has also been aggressively buying back its own stock, with a total of $18.3 billion in repurchases in 2020. This has helped to reduce the company's shares outstanding and increase its earnings per share.

Industry Trends and Competitors

Fintech Competition and Regulatory Environment

The fintech industry has been growing rapidly in recent years, with a range of new companies emerging to challenge traditional financial institutions. JPMorgan Chase has been investing heavily in digital transformation, with a focus on enhancing customer experience and improving operational efficiency. However, the company still faces significant competition from fintech companies, including PayPal, Square, and Robinhood.

Interest Rate Environment and Economic Uncertainty

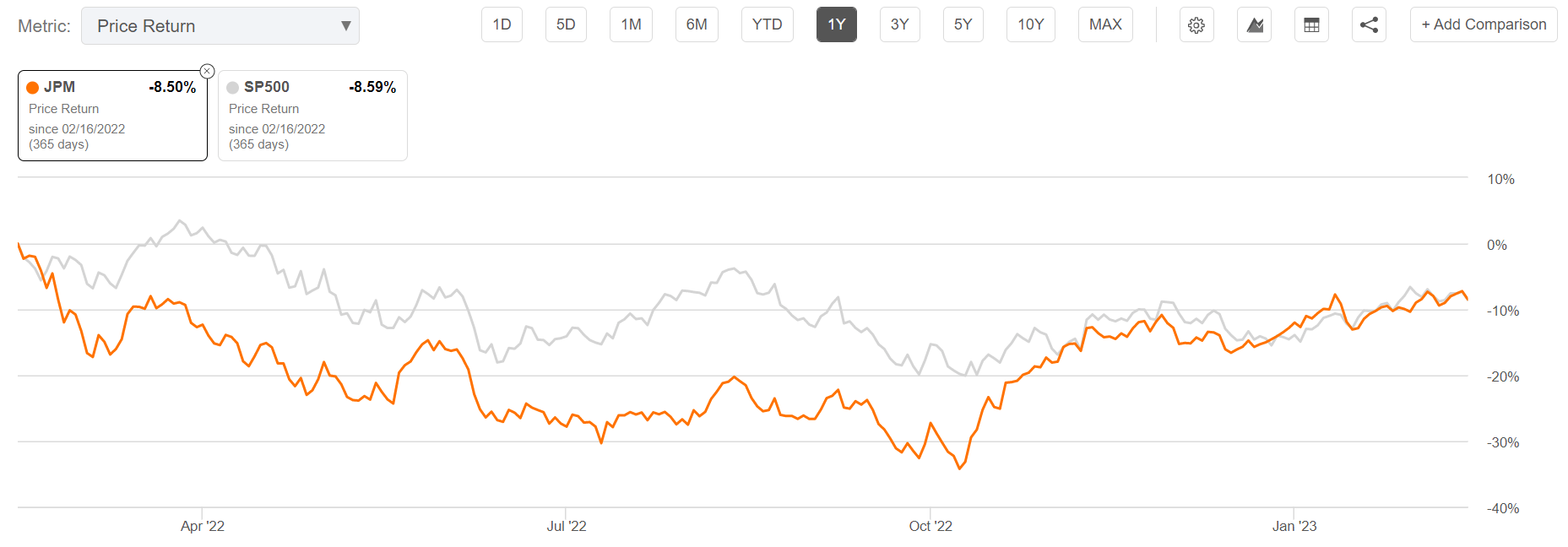

The interest rate environment has been declining in recent years, with the Federal Reserve lowering interest rates multiple times. This has had a significant impact on JPMorgan Chase's revenue, particularly in its consumer lending and commercial lending businesses. The company has been working to diversify its revenue streams and reduce its exposure to interest rate risk.

Competition from Large Financial Institutions

JPMorgan Chase competes with a range of large financial institutions, including Bank of America, Wells Fargo, and Citigroup. The company has a strong presence in the US market, but faces significant competition from these larger institutions. JPMorgan Chase has been investing heavily in digital transformation and cost management to improve its competitiveness.

Emerging Trends and Opportunities

Cryptocurrency and Blockchain

JPMorgan Chase has been exploring the use of blockchain technology and cryptocurrency, with a focus on improving the efficiency and security of its payment systems. The company has partnered with several blockchain startups, including Hashed and Blockchain Technologies, to develop new payment systems and blockchain-based services.

Digital-Only Banking and Mobile Payments

JPMorgan Chase has been investing heavily in digital-only banking and mobile payments, with a focus on enhancing customer experience and improving operational efficiency. The company has launched several digital-only banking products, including its digital-only bank, Chase Mobile, and its mobile payment platform, Chase Pay.

Underlined Key Points to Consider When Evaluating JPMorgan Chase Stock

Investors should consider the following key points when evaluating JPMorgan Chase stock:

- Strong financial performance and revenue growth

- Significant investments in digital transformation and cost management

- Commitment to innovation and R&D

- Exposure to interest rate risk and competition from fintech companies

- Emerging trends and opportunities in cryptocurrency, blockchain, and digital-only banking

Conclusion

In conclusion, JPMorgan Chase stock has the potential to be a strong investment opportunity for those looking to buy into a well-established financial institution with a strong presence in the US market. The company's commitment to innovation and digital transformation, as well as its strong financial performance and revenue growth, make it an attractive option for investors. However, investors should also be aware of the company's exposure to interest rate risk and competition from fintech companies, as well as emerging trends and opportunities in cryptocurrency, blockchain, and digital-only banking. By carefully evaluating these factors and considering JPMorgan Chase's overall financial health and competitive position, investors can make an informed decision about

Lance Barber Weight Loss

Michael Mando Partner

Kate Winsletrome

Article Recommendations

- Jelly Beansrome

- Fitbryceadams

- Competition Rank Tracker

- Big Meech Net Worth 2024

- Taylorwift Height And Weight

- Kari Lakethnicity

- Nikki Catsouraseathxplained

- Lee Ingleby

- Jack Mcbrayer

- Cecily Chapman