The Federal Student Loan Crisis: A ticking Time Bomb for Future Generations

As the cost of higher education continues to skyrocket, the burden of federal student loans falls squarely on the shoulders of young Americans. With millions of borrowers struggling to make ends meet, the system is in crisis. But what's behind this phenomenon, and how can we prevent it from becoming a ticking time bomb for future generations?

The U.S. Department of Education has issued over $1.7 trillion in federal student loans since 1993, with more than 45 million borrowers now carrying a collective debt of over $1.6 trillion. This staggering figure is not only crippling individual borrowers but also has far-reaching consequences for the economy and society as a whole. The crisis is multifaceted, driven by a complex interplay of factors including rising tuition fees, decreased funding for public universities, and inadequate support for borrowers.

The roots of the crisis can be traced back to the 1990s, when the government began to shift the responsibility for higher education from the state to the individual. This marked a significant turning point, as the assumption that students would take on debt to finance their education began to gain traction. While the idea seemed appealing at the time, it has since proven to be a recipe for disaster. Today, students are facing a debt burden that is unsustainable, leading to financial stress, delayed life milestones, and even bankruptcy.

The Anatomy of a Federal Student Loan

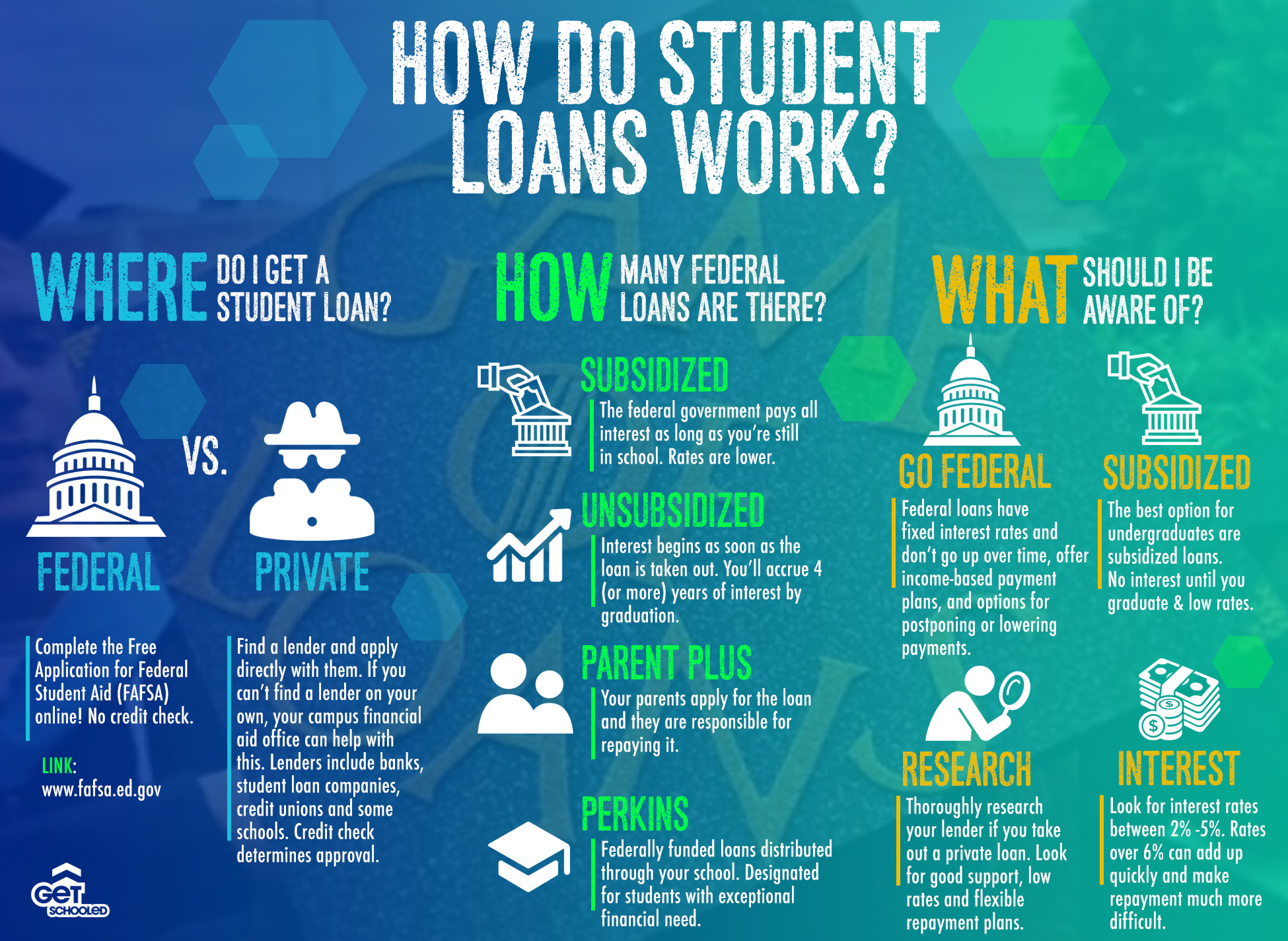

A federal student loan is a type of subsidized or unsubsidized loan issued by the federal government to help students cover the costs of higher education. There are two main types of federal student loans: Direct Subsidized and Unsubsidized.

- Direct Subsidized Loans: These loans are available to undergraduate students who demonstrate financial need. The government pays the interest on these loans while the student is in school and during a six-month grace period after graduation.

- Direct Unsubsidized Loans: These loans are available to undergraduate and graduate students, regardless of financial need. Borrowers are responsible for paying the interest on these loans from the time they are disbursed.

Other types of federal student loans include:

- Direct PLUS Loans: These loans are available to graduate students, parents of undergraduate students, and other eligible borrowers. They have a higher interest rate than Direct Subsidized and Unsubsidized Loans.

- Federal Perkins Loans: These loans are available to undergraduate students with exceptional financial need. They have a low interest rate, but are relatively rare.

The Consequences of Federal Student Loan Debt

The consequences of federal student loan debt are far-reaching and devastating. Some of the most significant effects include:

- Delayed Life Milestones: The burden of debt can prevent borrowers from pursuing their dreams, including buying a home, starting a family, or pursuing a business venture.

- Financial Stress: The stress of managing debt can lead to anxiety, depression, and even PTSD.

- Credit Score Impact: Defaulting on a federal student loan can significantly damage a borrower's credit score, making it difficult to secure credit in the future.

- Financial Inequality: The disproportionate burden of debt falls heavily on low-income and minority borrowers, exacerbating existing social and economic inequalities.

The Role of the Government in Addressing the Crisis

The government has a critical role to play in addressing the federal student loan crisis. Some potential solutions include:

- Income-Driven Repayment (IDR) Plans: These plans cap borrowers' monthly payments at a percentage of their income, making it easier to manage debt.

- Forgiveness Programs: Programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness can provide relief to borrowers in certain fields.

- Free College Tuition: Some lawmakers have proposed plans to provide free college tuition, which could significantly reduce the burden of debt.

The Future of Federal Student Loans

As the federal student loan crisis continues to escalate, it's essential to consider alternative solutions. Some potential options include:

- Private Student Loans: While often more expensive than federal loans, private student loans can provide access to credit for borrowers who are unable to qualify for federal loans.

- State-Sponsored Student Loans: Some states offer their own student loan programs, which can provide additional support for borrowers.

- Community-Supported Education: Non-profit organizations and community groups are working to provide affordable education options, reducing the need for federal loans.

Creating a Sustainable Education System

To prevent the federal student loan crisis from becoming a ticking time bomb for future generations, we need to create a sustainable education system. Some key steps include:

- Increasing Funding for Public Universities: This can help reduce tuition fees and make higher education more accessible.

- Improving Financial Literacy: Educating students and parents about the importance of financial planning and debt management can help prevent the crisis.

- Promoting Alternative Education Options: Programs like apprenticeships, vocational training, and online courses can provide alternative paths to education and reduce the burden of debt.

The federal student loan crisis is a complex issue that requires a multifaceted solution. By understanding the anatomy of federal student loans, the consequences of debt, and the role of the government, we can begin to address this crisis and create a more sustainable education system for future generations.

Barron Trump Heightisease

Mamitha Baiju

Anjali Arora

Article Recommendations

- Madison Beer Parents

- Zhao Lusi

- Is Justin Bieberead

- Icepice

- Richardean Anderson

- Spam Call Prank

- Brandon Hantz

- What Happened Toana Loesch Face

- 5starstocks

- Alison Neubauer