Rewriting Financial History: How Gen Z and Millennials Are Leading the Charge in Pay-by-Bank Adoption

The traditional banking system has been in existence for centuries, but recent advancements in technology have revolutionized the way we think about money management. The emergence of pay-by-bank, a payment system that allows users to link their bank accounts directly to their digital wallets, is a significant development in the fintech industry. This article will delve into the world of pay-by-bank adoption, focusing on the early adopters of this technology, specifically Gen Z and millennials.

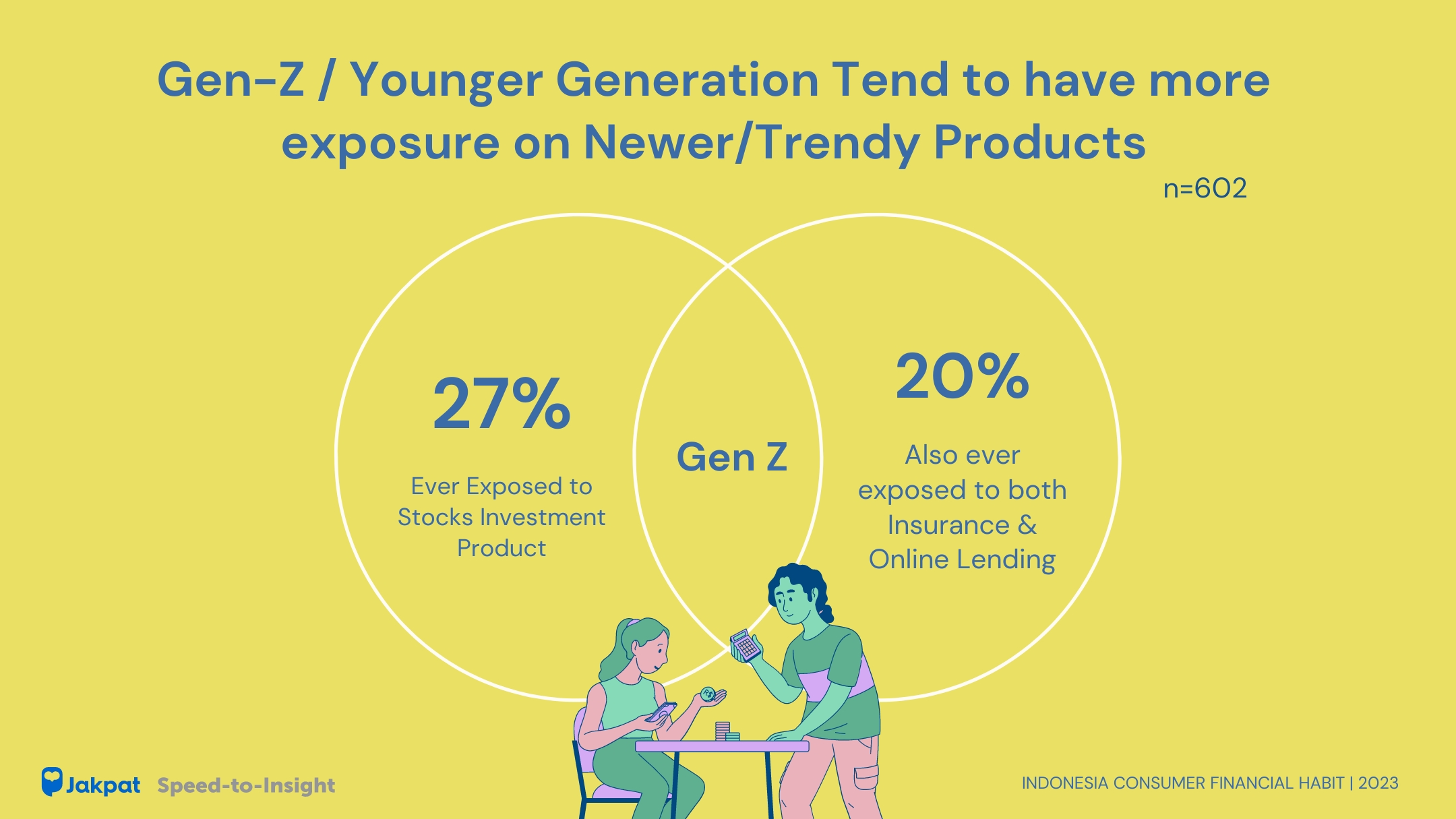

Gen Z and millennials have grown up in a digital age, where mobile payments, online banking, and digital wallets have become the norm. As a result, they have been among the earliest adopters of pay-by-bank technology. According to a report by Bank of America, 75% of millennials use mobile banking apps, while 60% of Gen Zers prefer digital payments over cash. This indicates that younger generations are more comfortable with technology and are eager to adopt innovative payment solutions.

The reasons behind the high adoption rate of pay-by-bank technology among Gen Z and millennials are multifaceted. One major factor is the convenience it offers. With pay-by-bank, users can make payments with just a few taps on their smartphones, eliminating the need for cash or credit cards. Additionally, pay-by-bank offers real-time updates, enabling users to track their transactions and balance easily. This level of transparency and control resonates with younger generations who value convenience and flexibility.

Another significant advantage of pay-by-bank is its accessibility. By linking their bank accounts to digital wallets, users can access their funds without the need for a traditional bank account. This opens up new opportunities for individuals who may not have had access to traditional banking services in the past. According to a report by Accenture, 40% of young adults in the US do not have a bank account, making pay-by-bank a game-changer for this demographic.

The Rise of Fintech and Pay-by-Bank

The fintech industry has experienced rapid growth in recent years, with pay-by-bank being a key driver of this trend. Fintech companies have developed innovative payment solutions that cater to the needs of younger generations. Pay-by-bank is one such solution that has gained significant traction in recent times.

Key Features of Pay-by-Bank

Pay-by-bank offers several key features that make it an attractive option for users. Some of the key features include:

- Real-time updates: Users can track their transactions and balance in real-time, eliminating the need for manual reconciliations.

- Convenience: Pay-by-bank allows users to make payments with just a few taps on their smartphones.

- Accessibility: Pay-by-bank offers users the ability to access their funds without the need for a traditional bank account.

- Security: Pay-by-bank uses advanced security measures to protect users' transactions and data.

Benefits of Pay-by-Bank for Gen Z and Millennials

The benefits of pay-by-bank for Gen Z and millennials are numerous. Some of the key benefits include:

- Increased convenience: Pay-by-bank offers users the ability to make payments and access their funds with just a few taps on their smartphones.

- Improved accessibility: Pay-by-bank provides users with the ability to access their funds without the need for a traditional bank account.

- Enhanced security: Pay-by-bank uses advanced security measures to protect users' transactions and data.

- Better financial control: Pay-by-bank offers users real-time updates, enabling them to track their transactions and balance easily.

Real-World Applications of Pay-by-Bank

Pay-by-bank has numerous real-world applications, including:

- Online shopping: Pay-by-bank enables users to make payments online with ease, eliminating the need for cash or credit cards.

- Mobile payments: Pay-by-bank allows users to make payments with just a few taps on their smartphones.

- Peer-to-peer transactions: Pay-by-bank enables users to send and receive payments easily, without the need for traditional banking services.

Challenges and Future Directions

Despite the many benefits of pay-by-bank, there are several challenges that need to be addressed. Some of the key challenges include:

- Regulatory compliance: Pay-by-bank companies must comply with various regulations, including anti-money laundering and know-your-customer regulations.

- Security concerns: Pay-by-bank companies must ensure that user data and transactions are secure.

- Adoption rates: Pay-by-bank companies must continue to innovate and improve their services to attract and retain users.

Future Developments in Pay-by-Bank

The future of pay-by-bank is exciting, with several developments on the horizon. Some of the key developments include:

- Integration with emerging technologies: Pay-by-bank companies are exploring the integration of emerging technologies, such as blockchain and artificial intelligence, to enhance their services.

- Expansion into new markets: Pay-by-bank companies are expanding into new markets, including developing countries and emerging economies.

- Increased focus on security: Pay-by-bank companies are placing a greater emphasis on security, including the use of advanced security measures to protect user data and transactions.

Conclusion

The adoption of pay-by-bank technology by Gen Z and millennials is rewriting financial history. With its convenience, accessibility, and security features, pay-by-bank is becoming an increasingly popular payment solution. As the fintech industry continues to evolve, it will be interesting to see how pay-by-bank companies address the challenges and develop new technologies to stay ahead of the curve.

Chloandmatt Fansd

Did Piddy Passed Away

Did Mason Lose His Leg

Article Recommendations

- Goblin Cave

- Michael Mando Uality

- Jordan Maxwell Howid Heie

- Joan Van Ark

- King Von Morgue

- Millie Bobby Brown

- Karlye Taylor

- Es Foo

- Claire Rushbrook

- Jennifer Landon