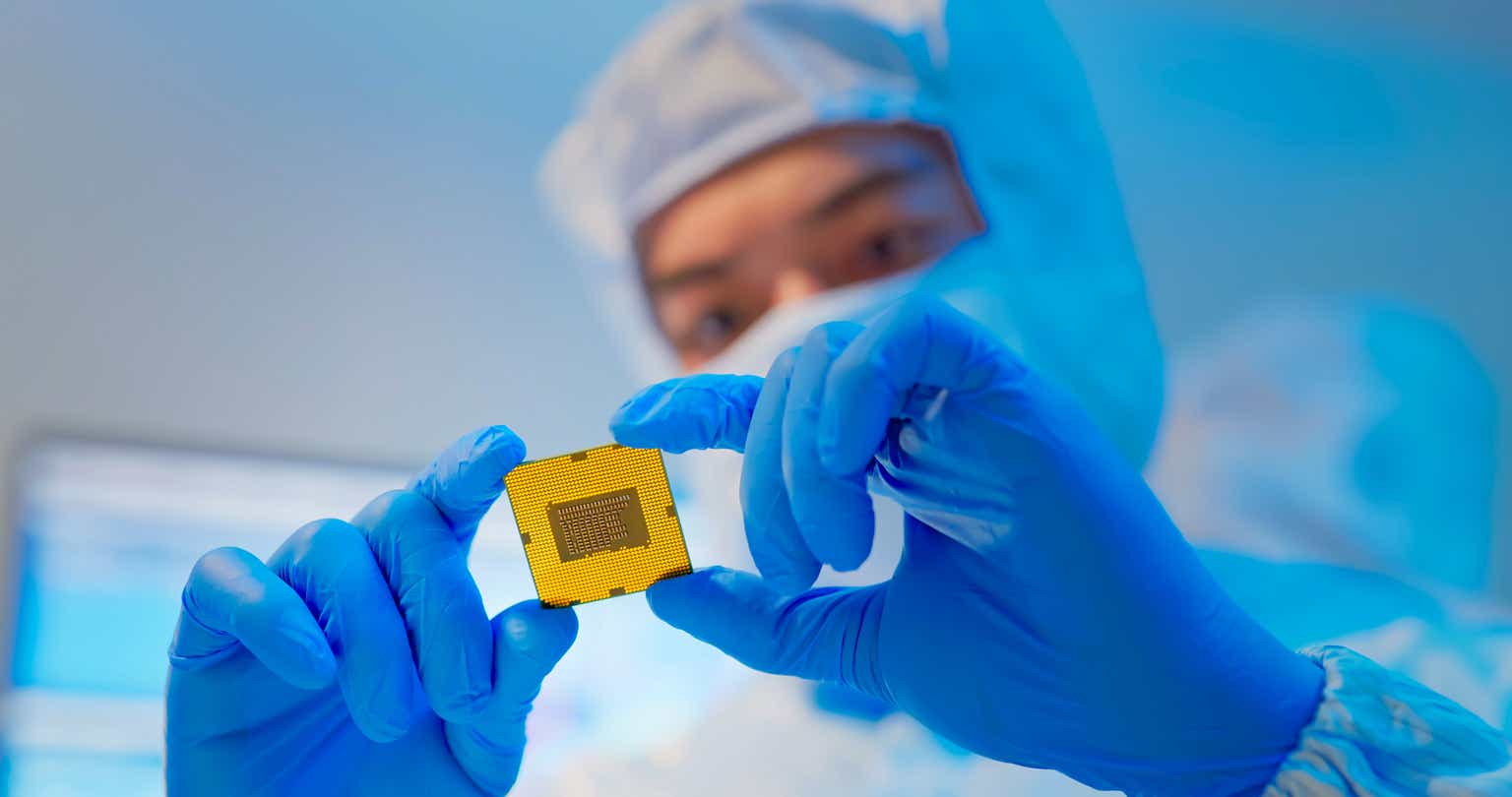

Taiwan Semiconductor's Shocking Blow To Intel: The Future Of Tech?

In the ever-evolving landscape of the tech industry, one thing is certain: innovation is the key to staying ahead of the curve. For decades, Intel has been the undisputed leader in the world of microprocessors, but a recent development has sent shockwaves throughout the industry. Taiwan Semiconductor Manufacturing Company (TSMC), a leading manufacturer of semiconductors, has made a bold move that could potentially disrupt Intel's reign. In this article, we'll explore the implications of this shocking blow and what it means for the future of tech.

TSMC's move to acquire Intel's 300mm wafer factory is a game-changer for the company. With this acquisition, TSMC will gain access to Intel's state-of-the-art manufacturing technology, allowing it to produce high-performance chips at an unprecedented scale. This move is not only a strategic coup for TSMC but also a significant blow to Intel's business model.

The Rise of TSMC

TSMC has been on a meteoric rise in recent years, with its stock price increasing by over 50% in the past year alone. The company's success can be attributed to its innovative approach to manufacturing, its commitment to R&D, and its ability to navigate the complex and often treacherous world of the tech industry.

Key Factors Contributing to TSMC's Success

• Innovative Manufacturing Process: TSMC has been at the forefront of 3D NAND flash memory manufacturing, which has enabled the company to produce higher-capacity chips at lower costs.

• R&D Investments: TSMC has made significant investments in research and development, including the establishment of its own IP (intellectual property) creation department.

• Strategic Partnerships: TSMC has formed partnerships with leading tech companies, including Apple, Google, and Amazon, to supply them with custom-designed chips.

The Impact on Intel

Intel's 300mm wafer factory is one of the most advanced manufacturing facilities in the world, and its acquisition by TSMC is a significant blow to the company's business model. Intel has long been the industry leader in microprocessors, but its dominance is being challenged by companies like TSMC and AMD.

Consequences of TSMC's Acquisition

• Loss of Competitive Advantage: Intel's acquisition of TSMC's 300mm wafer factory will likely result in the loss of its competitive advantage in the market.

• Reduced Profits: Intel's profits are expected to decline significantly as a result of TSMC's acquisition, which could have long-term implications for the company's financial health.

• Increased Competition: TSMC's acquisition of Intel's 300mm wafer factory will increase competition in the market, potentially leading to lower prices and reduced profit margins for Intel.

The Future of Tech

The acquisition of Intel's 300mm wafer factory by TSMC is a game-changer for the tech industry. It marks a significant shift in the balance of power, with TSMC emerging as a major player in the world of microprocessors. As the industry continues to evolve, it's clear that TSMC is well-positioned to take advantage of the opportunities presented by this acquisition.

Implications for Other Tech Companies

• Increased Pressure on AMD: The acquisition of Intel's 300mm wafer factory by TSMC could put increased pressure on AMD, which has been struggling to keep up with the competition in the microprocessor market.

• New Opportunities for TSMC: TSMC's acquisition of Intel's 300mm wafer factory presents new opportunities for the company, including the ability to produce high-performance chips at an unprecedented scale.

• Evolution of the Tech Industry: The acquisition of Intel's 300mm wafer factory by TSMC marks a significant shift in the evolution of the tech industry, with TSMC emerging as a major player in the world of microprocessors.

Conclusion

The acquisition of Intel's 300mm wafer factory by TSMC is a shocking blow to Intel, but it's also a significant opportunity for the company. As the tech industry continues to evolve, it's clear that TSMC is well-positioned to take advantage of the opportunities presented by this acquisition. With its innovative approach to manufacturing, its commitment to R&D, and its ability to navigate the complex and often treacherous world of the tech industry, TSMC is poised to become a major player in the world of microprocessors.

Key Takeaways

• TSMC's Acquisition of Intel's 300mm Wafer Factory: TSMC's acquisition of Intel's 300mm wafer factory marks a significant shift in the balance of power in the tech industry.

• Implications for Intel: The acquisition of Intel's 300mm wafer factory by TSMC is a significant blow to Intel's business model, potentially leading to reduced profits and increased competition.

• Future of Tech: The acquisition of Intel's 300mm wafer factory by TSMC marks a significant shift in the evolution of the tech industry, with TSMC emerging as a major player in the world of microprocessors.

In the ever-evolving landscape of the tech industry, one thing is certain: innovation is the key to staying ahead of the curve. With its innovative approach to manufacturing, its commitment to R&D, and its ability to navigate the complex and often treacherous world of the tech industry, TSMC is poised to become a major player in the world of microprocessors.

Karlanenio Case Pos

Who Is Rick Ross

Hisashi Ouchi Real Images

Article Recommendations

- Karlan And Connieenio Crimecene Pos

- Is Tony Hinchcliff Married

- Did Karla Homolka Parents Forgive Her

- Dingdongantes Height

- Jelly Beans

- Travis Kelce Health

- Is Justin Bieberead

- Mel Tiangco

- Matt Czuchry

- Kate