Check Your IRS Refund Status Online: A Quick and Easy Guide

Are you waiting for your IRS refund check and want to know the status? In this article, we will walk you through the easy process of checking your IRS refund status online. With just a few simple steps, you can determine if your refund has been processed and when you can expect to receive it.

The IRS (Internal Revenue Service) provides a convenient online service that allows you to check the status of your refund, saving you time and effort. By following these steps, you can quickly and easily determine if your refund has been processed and when you can expect to receive it.

Checking your IRS refund status online is a great way to save time and reduce the stress of waiting for your refund. In this article, we will provide a step-by-step guide on how to check your IRS refund status online, including the necessary information you need to know and the tools available to help you check your status.

Getting Started

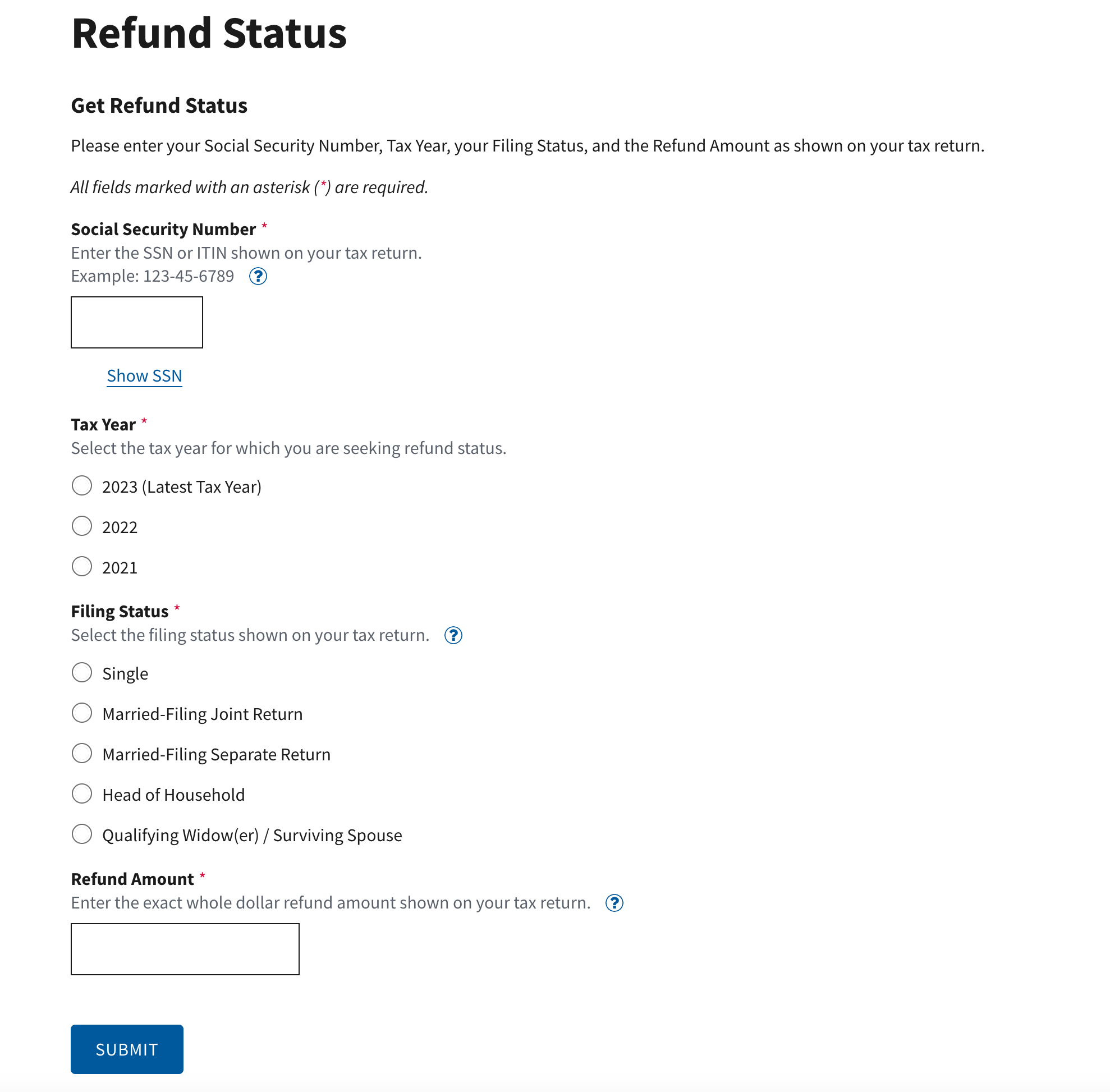

To check your IRS refund status online, you will need to have a few pieces of information available. The most important pieces of information you need are:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your date of birth

- The year you filed your tax return

You will also need to know the type of refund you are expecting. This could be a:

- Refund check

- Refund direct deposit

- Refund e-filed return

With this information, you can access the IRS's online refund status tool, where you can quickly and easily check the status of your refund.

Tools Available

The IRS provides several tools to help you check your refund status online. Some of the most popular tools include:

- The IRS Refund Status Tool: This tool allows you to check the status of your refund using your Social Security number or ITIN, date of birth, and the year you filed your tax return.

- The IRS Where's My Refund Tool: This tool allows you to check the status of your refund using your Social Security number or ITIN, date of birth, and the type of refund you are expecting.

- The IRS Get Transcript Tool: This tool allows you to access your tax return transcript, which includes your refund information.

How to Check Your Refund Status

To check your refund status, follow these steps:

- Visit the IRS website at www.irs.gov.

- Click on the "Help" tab at the top of the page.

- Click on "Refunds" and then select "Where's My Refund?"

- Enter your Social Security number or ITIN, date of birth, and the year you filed your tax return.

- Select the type of refund you are expecting.

- Click "Submit" to check the status of your refund.

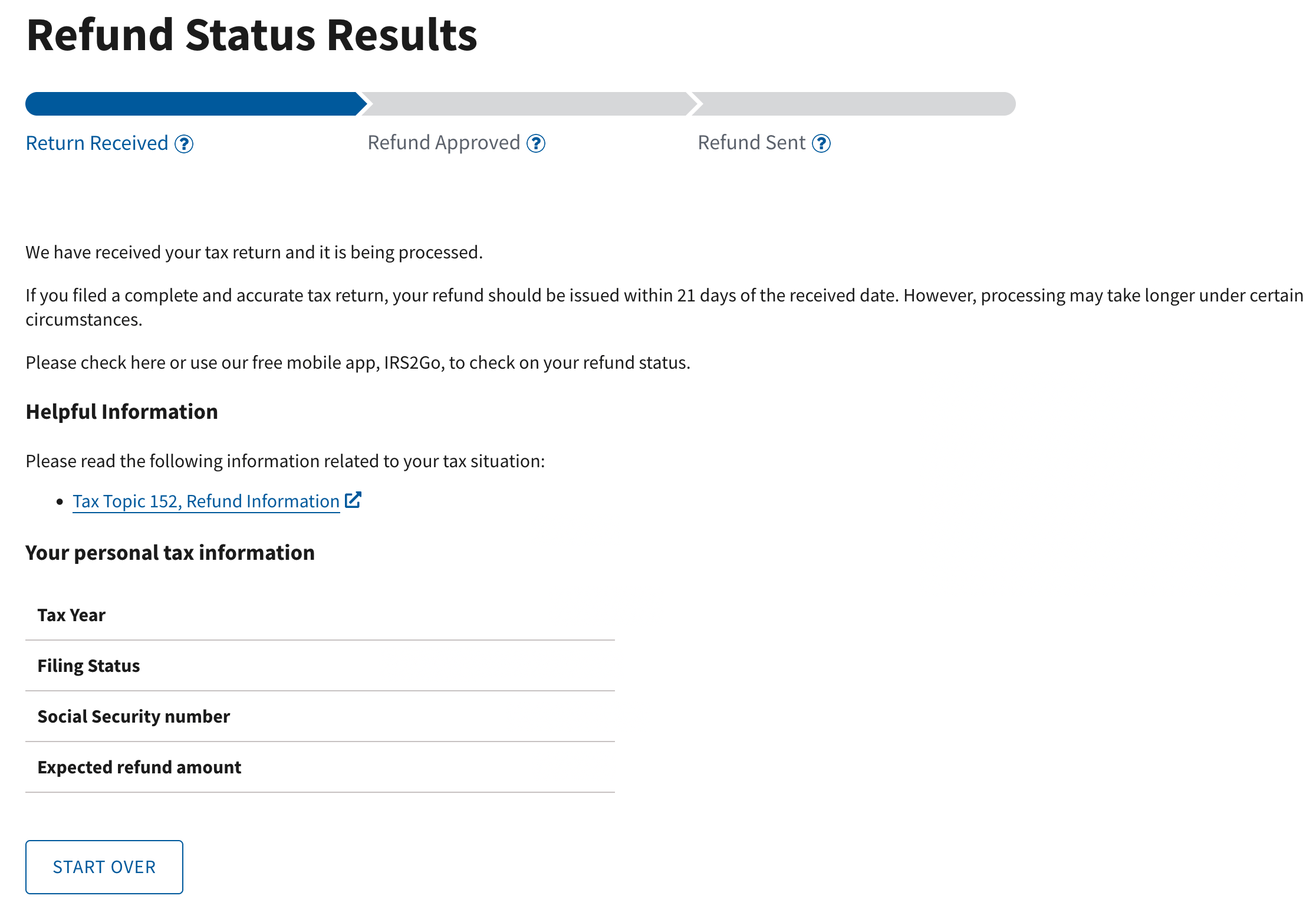

Refund Status Messages

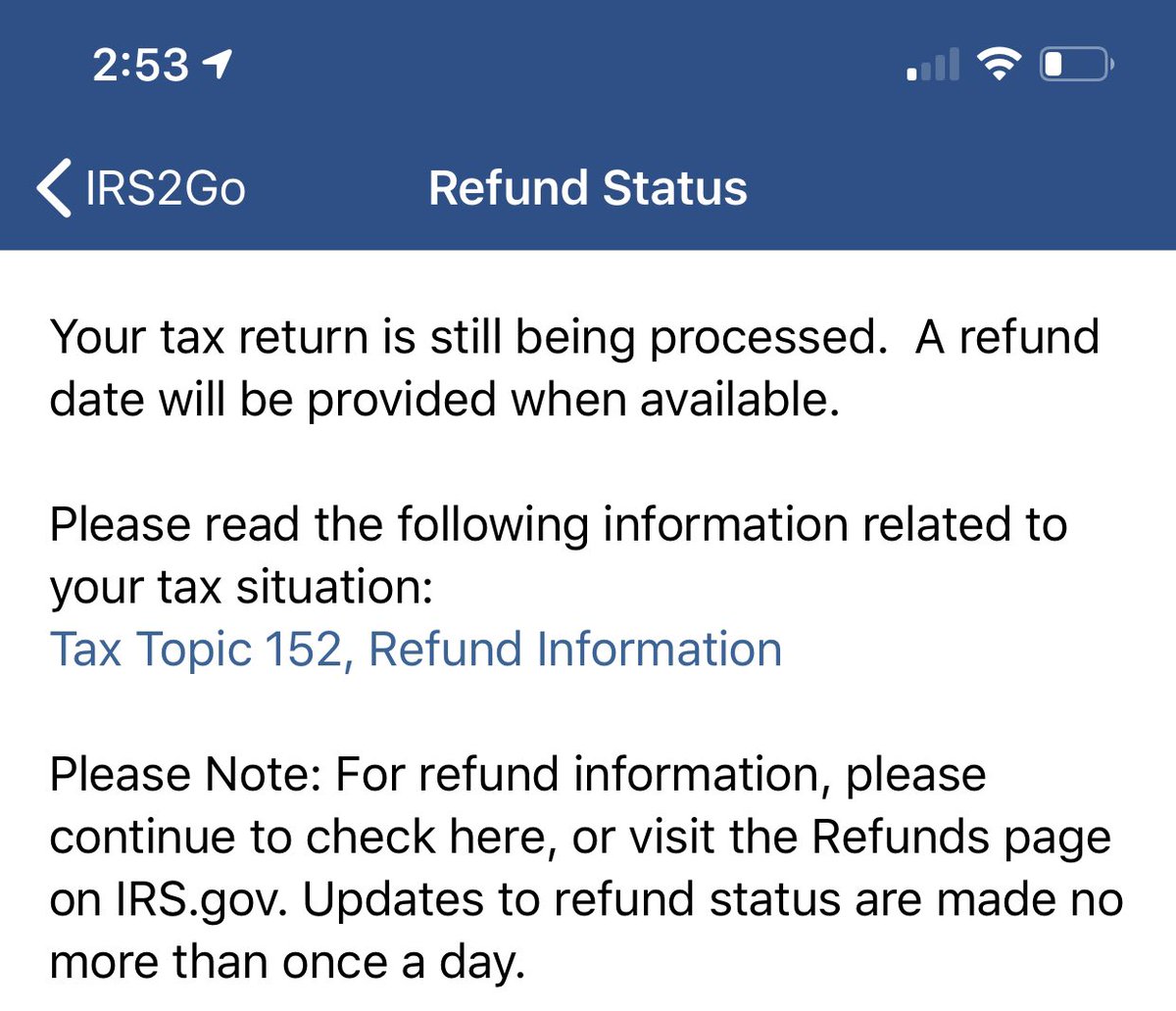

If you use the IRS Refund Status Tool or the IRS Where's My Refund Tool, you may receive a message indicating the status of your refund. The following are some common refund status messages:

- "Refund has been processed and will be mailed to you within the next 2 weeks."

- "Refund has been processed and will be direct deposited to your bank account within the next 2 weeks."

- "Refund has been processed, but we are unable to confirm the status of your refund at this time."

- "Refund has not been processed and is still pending."

Other Ways to Check Your Refund Status

In addition to using the IRS Refund Status Tool or the IRS Where's My Refund Tool, you can also check your refund status by:

- Calling the IRS Refund Hotline at 1-800-829-1040

- Visiting your local IRS office

- Checking your email or mail for a refund notification

Tips and Reminders

To ensure a smooth refund process, follow these tips and reminders:

- Make sure to sign up for direct deposit to receive your refund faster.

- Use the IRS Refund Status Tool or the IRS Where's My Refund Tool to check the status of your refund.

- Check your email or mail for a refund notification.

- If you experience any issues with your refund, contact the IRS Refund Hotline for assistance.

By following these steps and tips, you can quickly and easily check your IRS refund status online and receive your refund when it's ready. Remember to stay patient and persistent, as processing times can vary depending on the complexity of your return and the volume of returns being processed.

Jordan Maxwell Howid Heie

Candy Mansoneath

Google Places Local Rank Tracker

Article Recommendations

- Who Is Brian Adams Partner

- Who Is H L Ne Joy Partner

- Hopie Carlson

- Shannonharpe Wife

- Andielle Fans

- Taylor Breesey

- Michael Boulos

- Choi Jin Hyuk

- Hisashi Ouchi Real

- Johnny Crawford