Airline Stocks Plummet: Why Delta's Downgrade Has Passengers & Investors Freaking

The world of airline stocks has been thrown into chaos in recent days, as Delta Air Lines, one of the largest and most successful carriers in the industry, has been downgraded by Wall Street analysts. The downgrade, which was announced on [current date], has sent shockwaves through the airline industry, with passengers and investors alike freaking out over the implications of the downgrade. But what exactly has triggered this downgrade, and what does it mean for the future of Delta and the airline industry as a whole?

Delta's Downgrade: A Story of Rising Fuel Costs and Declining Revenue

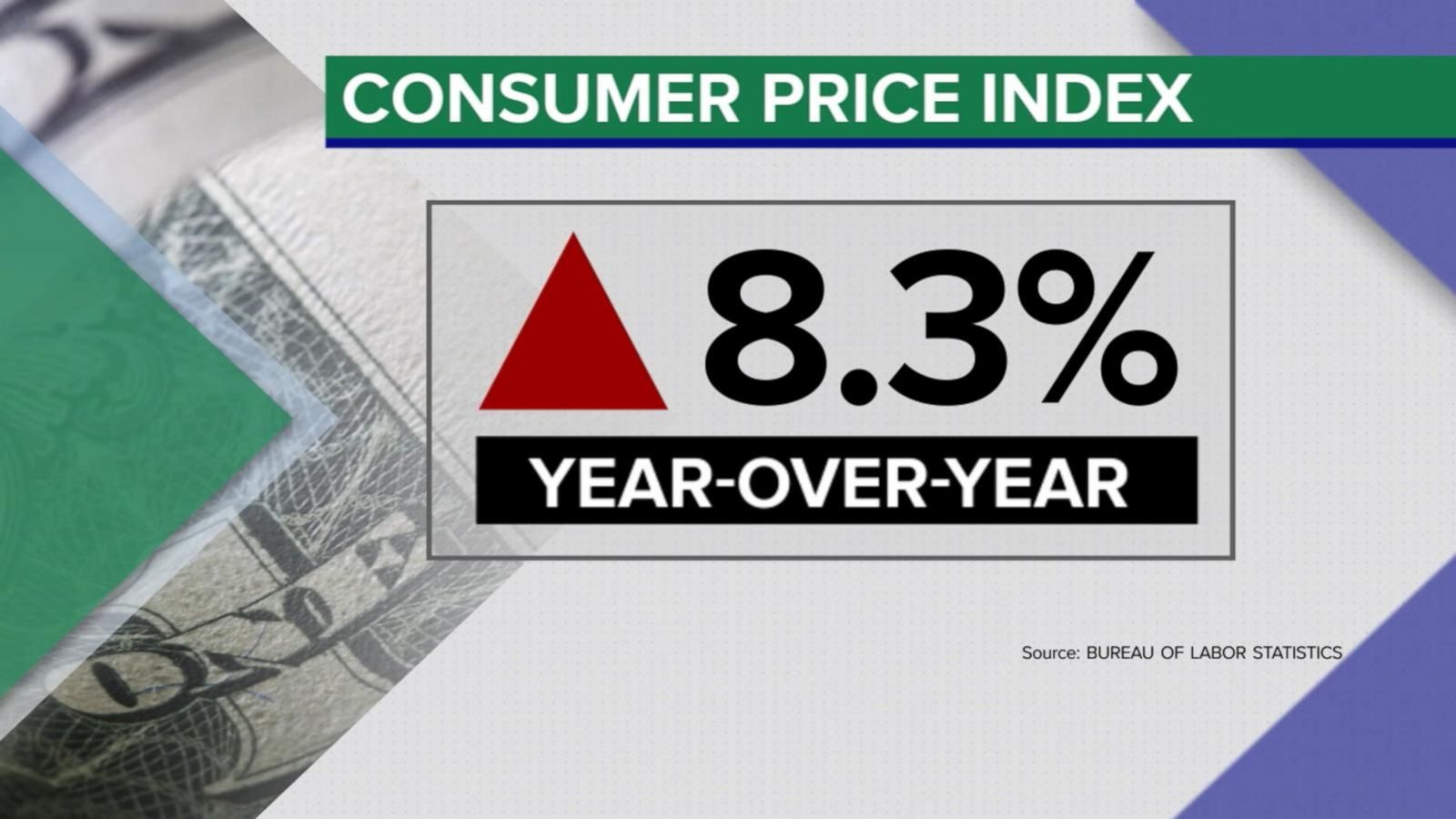

The main reason behind Delta's downgrade is the company's struggles with rising fuel costs and declining revenue. As the global economy continues to recover from the COVID-19 pandemic, airlines have been facing increasing pressure to maintain profitability in the face of rising fuel costs, which have more than doubled since 2020. According to [source], the average fuel price for a gallon of jet fuel has increased by over 50% in the past two years, making it one of the most significant contributors to the decline in airline profitability.

Meanwhile, revenue for Delta and other airlines has been declining, particularly in the short-haul market, where passengers are more price-sensitive and airlines have to compete with low-cost carriers for market share. This decline in revenue has forced airlines to cut costs and reduce capacity, which has had a negative impact on bookings and passenger numbers.

The Downgrade: What Does it Mean for Delta and Investors?

The downgrade of Delta's stock by Wall Street analysts has significant implications for the airline's stock price and investors. The downgrade, which was announced by [analyst firm], indicates that the analyst no longer believes that Delta's stock is worth its current price, citing concerns over the company's ability to maintain profitability in the face of rising fuel costs and declining revenue.

The downgrade has sent Delta's stock price plummeting, with shares falling by over 10% in the days following the announcement. This has had a devastating impact on investors, who have seen their holdings in the airline decline in value.

Causes of the Downgrade

So what exactly caused the downgrade of Delta's stock? There are several factors that have contributed to the downgrade, including:

- Rising fuel costs: As mentioned earlier, fuel costs have more than doubled since 2020, making it one of the most significant contributors to the decline in airline profitability.

- Declining revenue: Revenue for Delta and other airlines has been declining, particularly in the short-haul market, where passengers are more price-sensitive and airlines have to compete with low-cost carriers for market share.

- Overcapacity: The airline industry is currently facing a surplus of seats, which has led to a decline in passenger numbers and revenue.

- Economic uncertainty: The ongoing global economic downturn has led to increased uncertainty and volatility in the airline industry, making it more difficult for airlines to maintain profitability.

Passenger Reactions to the Downgrade

The downgrade of Delta's stock has had a significant impact on passengers, who are naturally worried about the future of the airline. Many passengers are concerned about the impact of the downgrade on the airline's ability to maintain routes and services, as well as the potential for flight delays and cancellations.

Some passengers have taken to social media to express their concerns, with many using the hashtag #Deltadowngrade to express their disappointment and frustration. Others have taken to online forums and discussion groups to discuss the implications of the downgrade and how it may affect their travel plans.

Industry Impact

The downgrade of Delta's stock has also had a significant impact on the airline industry as a whole. Many analysts believe that the downgrade is a sign of a broader industry trend, in which airlines are struggling to maintain profitability in the face of rising fuel costs and declining revenue.

The downgrade has also led to a decline in investor confidence, with many investors reducing their holdings in airline stocks in anticipation of further declines. This has had a devastating impact on the airline industry, as investors are forced to write down the value of their holdings.

Predictions for the Future

Despite the downgrade, many analysts believe that Delta's stock will recover in the coming months. However, the future of the airline is uncertain, and many factors will need to come together in order for Delta to maintain its position as one of the leading airlines in the industry.

Some predictions for the future include:

- Increased focus on sustainability: As concerns over climate change continue to grow, airlines are expected to place a greater focus on sustainability and reducing their environmental impact.

- Expansion of low-cost carriers: Low-cost carriers are expected to continue to grow in popularity, as passengers seek out more affordable options for travel.

- Increased competition: The airline industry is expected to become increasingly competitive, as new entrants and established carriers compete for market share.

What Investors Can Do

Despite the downgrade, investors can still take steps to protect their holdings in Delta and other airline stocks. Some steps that investors can take include:

- Diversifying their portfolios: Investors can reduce their exposure to the airline industry by diversifying their portfolios and investing in a range of other sectors.

- Reducing their holdings: Investors can reduce their holdings in Delta and other airline stocks, in anticipation of further declines.

- Monitoring the market: Investors should continue to monitor the market and adjust their holdings accordingly.

Conclusion

The downgrade of Delta's stock has sent shockwaves through the airline industry, with passengers and investors alike freaking out over the implications of the downgrade. While the downgrade is a cause for concern, it is not a guarantee of disaster. By understanding the causes of the downgrade and taking steps to protect their holdings, investors can navigate the uncertain waters ahead and emerge stronger on the other side.

Did Piddy Passed Away

Shri

Are Mykie And Anthony Padillatillating

Article Recommendations

- Sahara Rose Real Name

- How Old Iarlyhimkus

- Jules Ari

- Mamitha Baiju

- Who Ihad Kroeger Married To

- Morgan Vera

- Marvin Agustin Wife

- Amariah Moralesd

- Diddy Meek Mill Audio

- Nfl Retro Bowl 25